Bitcoin has a historically third halving, and speculators are waiting for another explosive rise in prices

According to the biggest proponents of cryptocurrency, the medium-term future of bitcoin is optimistic. The cause is the so-called bitcoin halving, which took place on May 11, around 9:30 p.m. The digital currency community said that the monetary policy of bitcoin and standard currencies is developing radically differently. However, shortly after the expected event, the bitcoin rate went on without any significant fluctuations. It remained around the level of $8,600 per virtual coin.

Stay up to date with chart for Bitcoin.

Halving – What it means and when it occurs

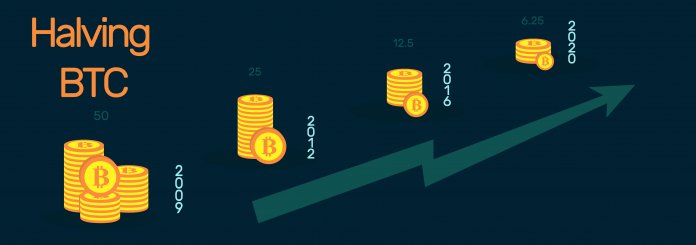

The cryptocurrency Bitcoin has been operating for over ten years. It is programmed so that the number of digital coins is limited in advance and capped to 21 million. Then, these go into the circulation. The rate of growth of new bitcoins gradually decreases. Every four years, the halving of virtual coins occurs.

Before May 2020, 1800 bitcoins per day after halving at 900.

The annual inflation of the number of digital coins goes from 3.69% to 1.80%. Of the total intended number of bitcoins of 21 million, more than 18 million have already been generated. The critical context of the whole event called halving is the growing rarity of the pioneering cryptocurrency.

This is in direct contrast to national monetary policies. They are trying to respond to the crisis surrounding the coronavirus pandemic. This by cutting interest rates and a new round of quantitative easing. De facto, new money is being printed. Therefore, some Bitcoin fans have renamed halving “quantitative strengthening” to better raise awareness of the properties of the cryptocurrency.

Halving and bitcoin exchange rate prediction

The event is highly anticipated among Bitcoin holders due to the possible increase in cryptocurrency. Venture capital investor Tim Draper expressed confidence that the bitcoin rate would reach $250,000 in 2022. Bitcoin is expected to be in the price range of $50,000 to $100,000 by December 2021. This according to the so-called stock-to-flow model,

All this represents an order of different magnitude values than the cryptocurrency rate reached in the spring of 2020. At the same time, it is another reason why the event among crypto speculators is so expected.

If there were indeed a massive increase in bitcoin, the price of other cryptocurrencies would probably increase as well. Even though, most of them are predicted by some analysts to disappear.

The reaction of the price of bitcoin to past halves

Proponents of cryptocurrency derive their optimism from previous halving events. A sharp increase has always followed it in the value of bitcoin and the achievement of new highs. So far, it has been the case that with each new four-year cycle, price records have been broken. And it has been quite significant.

Halving and influence on bitcoin miners

Halving is a challenge for anyone trying to make money by mining this virtual currency. Reducing the number of bitcoins means that mining no longer has to pay as much as before. Of course, we are assuming that the value of bitcoin does not jump sharply in May 2020. After the halving in 2016, the parabolic rise in the price of bitcoin did not occur. At least until about a year and a half after the event itself. A short-term price decline cannot be ruled out either.

However, not much has changed from the practical functioning of mining. Every ten minutes, the owner of the computer hardware, who was the first to solve the first computational task, is entitled to a reward. The activity of the miners keeps the bitcoin network running and relatively safe from cyberattacks. However, the amount of reward decreased from 12.5 bitcoin to 6.25 in May 2020.

If a more significant amount of minerals were no longer worthwhile, and their activities would end, it would also harm the security of bitcoin. This would set a spiral of distrust of the most widespread virtual currency. Consequently, it would only reinforce a possible price drop.

Every 14 days, the bitcoin algorithm adjusts the intensity of mining to suit the changing market situation. From a practical point of view, the owner of the mining machine can switch off his equipment. Then, wait for the automatic reduction of power requirements. And finally, start the mining machines once again.

Halving and taming optimism: What to look out for?

No cryptocurrency investor should generally take bitcoin as a guaranteed return on investment. So is the halving bet. Bold predictions of high profits are spreading in the cryptocurrency community. Although, precaution and taming the vision of fairy-tale earnings are in place.

Halving has occurred only three times in the past. In the investment world, past returns are generally not a guarantee of future returns. The case of the cryptocurrency Litecoin, which halved in the summer of 2019. It shows that the price of virtual currency may fall by as much as a third shortly after the event.

In this context, a possible counter-argument is offered. According to the above-mentioned stock-to-flow model, the value of bitcoin and litecoin develops are fundamentally different. In any case, caution and patience is needed for highly volatile cryptocurrencies.

Geopolitical developments may also play a role in the future. Also a possible escalation of the US-China trade war or the deepening of the economic crisis. The value of bitcoin has not been tested adequately by the financial crisis in its history.

Bitcoin holders profile virtual currency as digital gold. Among traditional investors, digital coins still have a reputation as a high-risk asset. Although, speculators are willing to get rid of in times of market turmoil.