The recovery of the cryptocurrency market has encouraged the primary producer of mining hardware to prepare to subscribe to shares

It looks like market recovery is back for cryptocurrencies.

The world’s leading manufacturer of Bitcoin mining equipment, Bitmain, is reviving IPO plans. In September the Chinese company was about to enter to the Hong Kong Stock Exchange, which eventually wasn’t realized. Bitmain is now preparing to join one of the U.S. stock exchanges, as Bloomberg’s sources stated.

When it will happen?

Although Bitmain’s representatives filled out the necessary documents to enter the Hong Kong Stock Exchange last year, their plans eventually failed. Now, with the help of a team of advisors, they are preparing to issue shares in the United States, and the subscription could take place in the second half of this year, Bloomberg said. After that, Bitmain will hand over the necessary documents to the U.S. Securities and Exchange Commission in July. The company could get between three and five hundred million dollars by subscribing, Bloomberg said. Therefore, because the company wanted to raise three billion dollars, the plans to enter the Hong Kong Stock Exchange became significantly more ambitious. It is expected that digital currencies will go higher with the recovery of the cryptocurrency market.

Bitmain in U.S. Stock Exchange

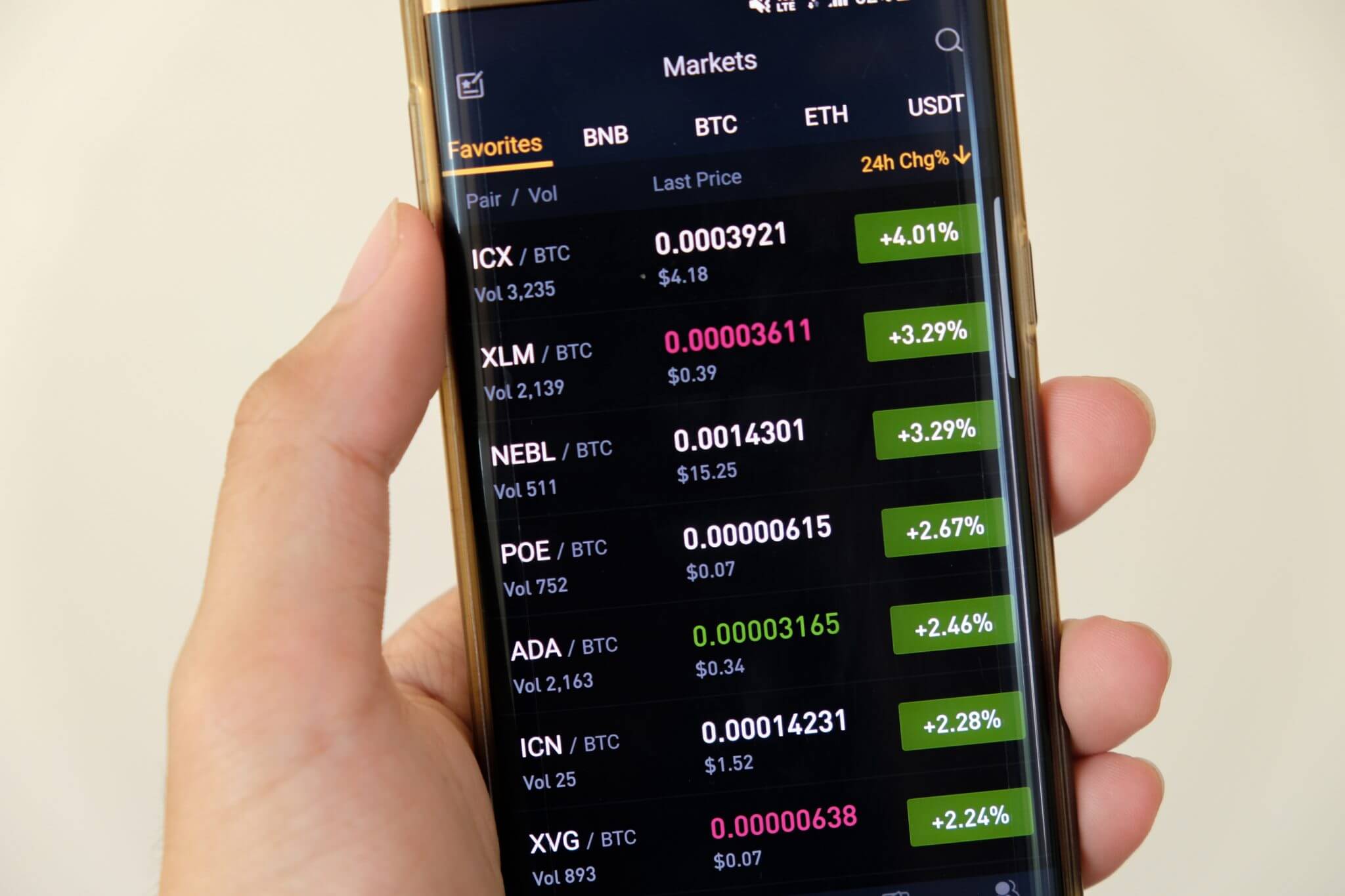

This Chinese giant is not the only company that considered entering the Hong Kong Stock Exchange, and is now considering an IPO in America. Similarly, its smaller competitor, Bitmain Canaan, has followed the same route. In Addition, Bitmain is preparing to enter the U.S. Stock Exchange at a time when the price of the most commonly used cryptocurrency Bitcoin has risen to over ten thousand dollars per coin, the highest value since last March. The Chinese company is a major manufacturer and supplier of the hardware necessary to mine this cryptocurrency. According to Bloomberg, they control about 80% of the market.