The current EU inflation rate is the highest since the creation of the eurozone affect the living standards of Europeans. And it is fast becoming a political issue. In the euro area as a whole, consumer prices have risen just over 5 percent. However, they reached double-digit values in some places, such as Lithuania. In Germany, where inflation is a hot topic, prices rose the fastest in 30 years in January – by 5.1 percent. Bloomberg has asked people in several euro-paying countries how they are coping with rising costs and whether state aid is adequate.

The current EU inflation rate divided by countries:

Germany

- January inflation rate: 5.1%

- Forecast for 2022: 3.7%

The current EU inflation rate is highly corresponding to Europe’s number one economy, rapid inflation is hurting the poor. Interest in the services of Tafel, which distributes discarded food to those in need in Germany, is on the rise, he says. Authorities have already begun sending out annual energy bills. The head of the local branch in Brandenburg, a der Havel, Griseldis Gray, receives requests for assistance from those who have so far hesitated.

Berlin has approved one-off payments to help the socially disadvantaged pay for electricity and heating. However, according to charities, this is not enough, and they demand additional help for the unemployed. At the same time, low-income households suffered earlier when they lost traditional support in school lunches during lockdowns.

Inflation is an emotional topic in Germany. The European Central Bank has often criticized Bild’s largest tabloid newspaper for its inaction, often describing consumer hardship. But Tafel himself also feels the pressure. His fleet costs and electricity bills are rising. He is increasingly asking for help from the local government or donations.

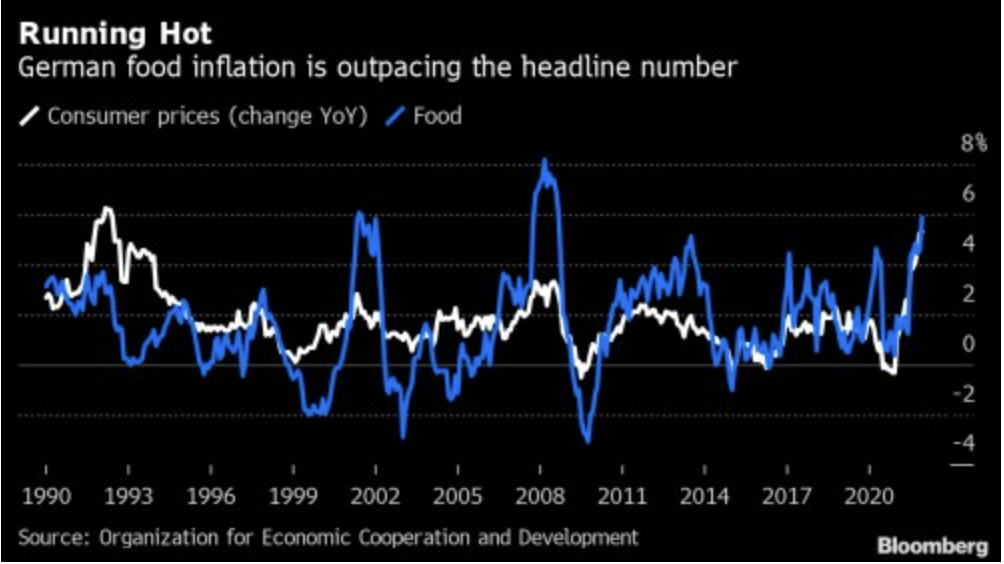

Food price inflation in Germany exceeds primary inflation:

France

- January inflation rate: 3.3%

- Forecast for 2022: 2.8%

The local gastronomic totem: the baguette, says a lot about being pushed by a shoe-in France. Bread prices have risen by only 23 euro cents over the last two decades. They have remained at the same level during the latest inflation wave. However, bakers have to deal with rising raw material costs and rising minimum wages. But they are not willing to pass on higher spending to consumers, says Dominique Anract, head of the French Federation of Bakers and Confectioners. Instead, they consider other options. For example, they put on items such as cakes or pastries, which are not the subject of daily consumption. Some are waiting for the summer holidays, which is a more typical time for revaluation.

“Baguettes are mythical in France. It’s the only thing you can buy when you don’t have enough money, “says Anract. “People are very sensitive to the price increase, and bakers do not want anyone to follow them.”

However, French consumers are also being saved in other areas. The cost to the government has been caused by capping electricity and gas prices. The move, by which the Insee statistical office estimated that it had cut core inflation by about one percentage point. It is thus one of the lowest in the euro area.

Italy

- January inflation rate: 5.3%

- Forecast for 2022: 3.8%

Italians also benefit from significant government assistance. Rome has spent over € 10 billion to curb rising energy prices. Prime Minister Mario Draghi promises continued protection for families and further support for companies that claim they are worried the most.

However, Italy’s national debt is 150 percent of GDP, and this support is, according to some, sustainable. In addition to energy, other factors such as drought and congested bottlenecks in supply chains and overhead costs in companies are raising Italian spaghetti and coffee prices.

Marco Campione, who owns four hair salons in the center of Rome, feels the inflation breathing on his back. The cost of small items, such as protective plastic coats over clothes, has doubled in a short time, from eight euro cents to 20.

As a customer, “you don’t see a huge increase in prices, but things add up, and at the end of the month, you find that you have spent an extra 100, 200 euros,” he says. “As an entrepreneur, I perceive it more. We try to be calm and not raise prices, but it can quickly get out of hand. “

However, the sign at a nearby ice cream parlor tells us about the changes: “Due to the continuing and exponential increase in raw material costs, we were forced to raise prices.”

Lithuania

- January inflation rate: 12.2%

- Estimate for 2022: 6.7%

Twenty-eight-year-old Lithuanian Karolina Kirbyte sometimes travels 18 kilometers while visiting her family on the Lithuanian-Polish border and stops at a turn in Poland. But now, in February, the parking lot of the Polish grocery store he usually goes to was full of cars with Lithuanian license plates. When she finally found a place, she spent an hour in line with her natives, who were here first. Some covered over 100 kilometers.

The reason is the temporary anti-inflation measures introduced by the government in Warsaw. These include a reduction in VAT on fuel and a zero rate on food.

In Lithuania, inflation is growing the fastest in the euro area. A year ago, it was almost zero. While the government subsidizes energy and may introduce a transitional zero DPA rate for heating, food, which cuts the largest share of the consumer basket, is becoming more expensive at a double-digit rate.

According to Kirbyte, who lives in Vilnius, prices in her homeland are brutal. “About once a month, we go to Poland for food, and we save a little,” she said. “If we had to buy everything for Lithuania, food, diapers, clothes, it would be challenging.”

Spain

- January inflation rate: 6.2%

- Forecast for 2022: 3.6%

In almost ten years, Paloma Jáudenes opened its first children’s clothing store in Cartagena, Spain. He survived a divorce, financial crisis, and pandemic during that time. Inflation can be the biggest problem for a mother of four whose business has grown into a small women’s clothing chain.

“Every day, every day, I receive e-mails from suppliers raising prices,” says Jáudenes, 44. “Everything is more expensive now, from fuel for cotton delivery to making clothes. I decided to operate in the style of a war economy. “This means moving operations to a new warehouse to reduce rental costs, shorten the working hours of some employees, and deal with retailers for cheaper plastic bags and price tags.

Its measures could take longer now. Prime Minister Pedro Sanchez has warned that energy prices are likely to rise. Inflation at the 30-year high is particularly severe for small and medium-sized enterprises such as its own. At the same time, they employ about half of the country’s workforce. Government support is focused on customers.

In her home region of Murcia, Jáudenes became a local celebrity. More than 6,500 liars were collected by her tweet about how her electricity bill had almost doubled. Like her, other business people may have to tighten their belts to stay afloat.

“I live from day to day,” says the businesswoman. “It is impossible to plan for the future. The only way to survive at such high prices is to make changes and adapt.” So follow the latest news to stay up to date on the current inflation rate in the EU, as the situation changes every day!

(Source: Bloomberg)