This is a question not only for small investors, but also for a number of professional investors and funds. The current analysis of the CFA Institute offers a pragmatic answer. How much bitcoin you should have in your investment portfolio?

I have long resisted the temptation to add bitcoin to my portfolio. Although I did the first major interview about it on the Investment Web many years ago and I know many leaders of the cryptocurrency community personally. But when I tried first-hand how cryptocurrencies were mined, transferred and used for payment, I stopped considering bitcoin as a purely speculative tool. I started working with it as an integral part of my portfolio.

After 2020, when the global debt shot into the stratosphere, about 15 trillion new dollars were printed. American politics is going through a blue wave. I no longer doubt bitcoin in my portfolio at all.

Investment portfolio including cryptocurrencies

I came across a study by the CFA Institute. It analyzes cryptocurrencies in the context of their inclusion in the classic portfolio of stocks and bonds. The analysis shows that the addition of bitcoin to the portfolio had a significant positive impact. At least on the long-term performance of the portfolio. Of course, this is a classic back modeling.

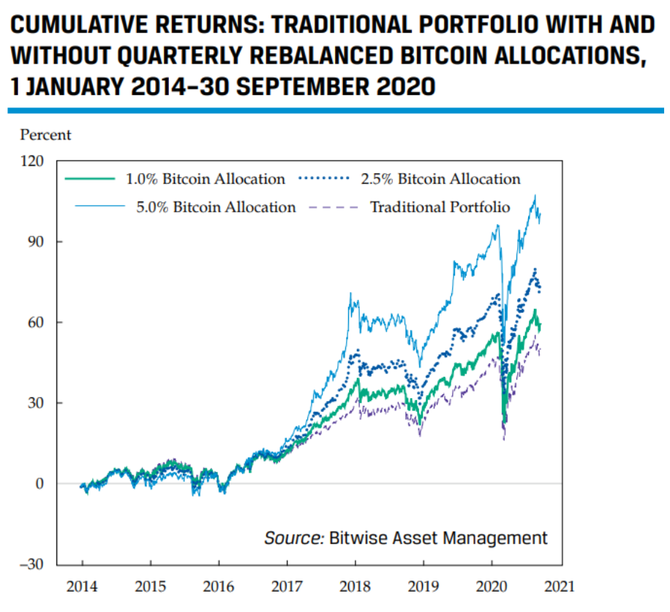

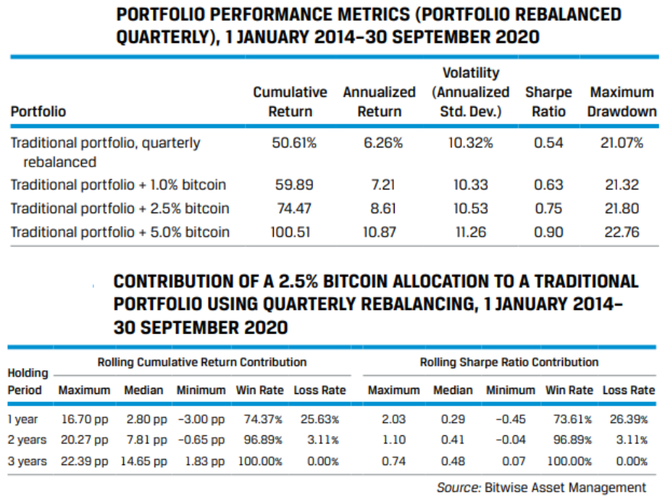

During the period considered (1 January 2014 to 30 September 2020), for example, a 2.5% allocation of money to bitcoin would improve the yields of the traditional 60/40 portfolio. This by 23.9 percentage points. Interestingly, volatility would remain almost the same (10.5% vs. 10.3%).

In the graphics, you can see the impact of allocating money to bitcoin between 0% and 10% over three-year periods. For example, allocating 1% of money to bitcoin added an average of 5.3 percentage points. It also strengthened the Sharpe ratio by 0.19. The 5% bitcoin allocation added 28.1 percentage points to portfolio performance and the Sharpe ratio rose 0.69.

However, when the share of bitcoin increases above 4%, the maximum decrease from the maximum to the minimum for a given period (drawdown) rises really fast about a point. At least each increase in the position by a percentage point. The 4% addition of bitcoin in the classic investment portfolio could be a certain ceiling for investors sensitive to risk.

It should be noted that in 2020 bitcoin began to be perceived by large institutions, asset managers and family offices as a full-fledged asset. This in addition to the diversification function highlighted by the CFA Institute study. Even after the steep growth, the market capitalization of bitcoin has not yet approached the capitalization of traditional investment markets.

Conclusion

Some may consider bitcoin to be a huge bubble after its growth over the past twelve months. But, isn’t the whole financial system based on fiat currencies perhaps an even bigger bubble? I see bitcoin as an interesting opportunity for diversification for your investment portfolio.