In a short period of time, cryptocurrency has gone from a small, alternative investment to one worth about $2 trillion dollars. You’ve probably heard of Coinbase if you’re wanting to invest in cryptocurrency or use it as a means of payment, so today, lets learn all about CoinBase so you can start earning. After all, it’s one of the most popular cryptocurrency exchanges online, with tens of millions of members. It’s also one of the simplest ways to purchase cryptocurrency, which has contributed to its explosive rise in popularity.

What is Coinbase?

Coinbase is a cryptocurrency exchange that allows you to purchase popular coins such as Bitcoin, Ethereum, and Litecoin. Although not every coin is offered by Coinbase, the platform does support over 90 distinct types of cryptocurrencies. Meanwhile, dozens of different cryptocurrencies are available all around the world. Coinbase, on the other hand, allows you to exchange the most common types of cryptocurrency, so it’s suitable for most uses.

All of this makes Coinbase a good choice for new crypto investors looking to purchase and sell their preferred coins.

How to open an account on Coinbase?

Read the in-depth process of account creation. Learn all about CoinBase so even you can earn with cryptocurrencies.

Step 1: Go to Coinbase

Visit the official Coinbase website. Click RIGHT HERE to get started.

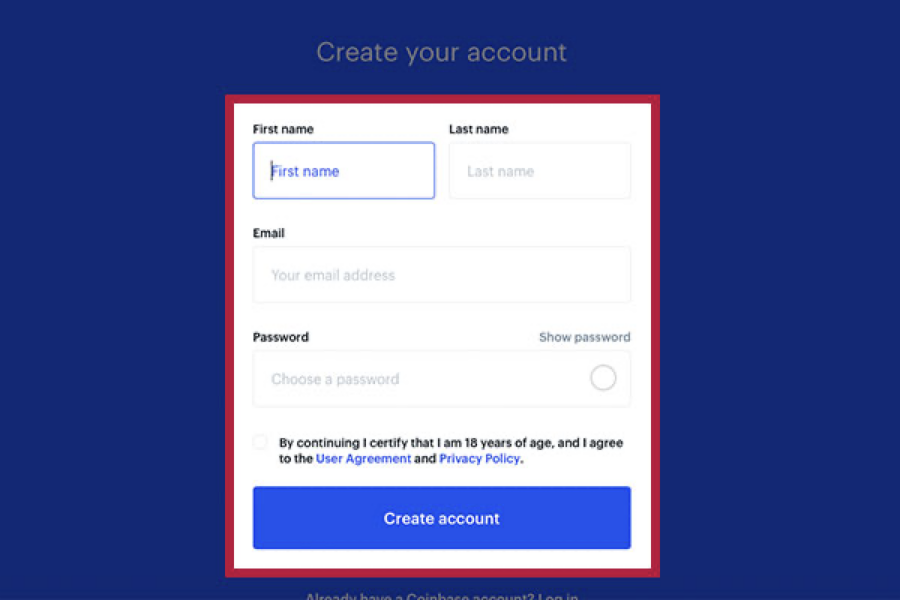

Step 2: Enter your personal information.

You’ll be asked for the following information: Use your legal full name (your first and last name), email address (use one that you have access to), Password (enter the one you’ll remember). Read the User Agreement and Privacy Policy. Check the box and click “Create account.”

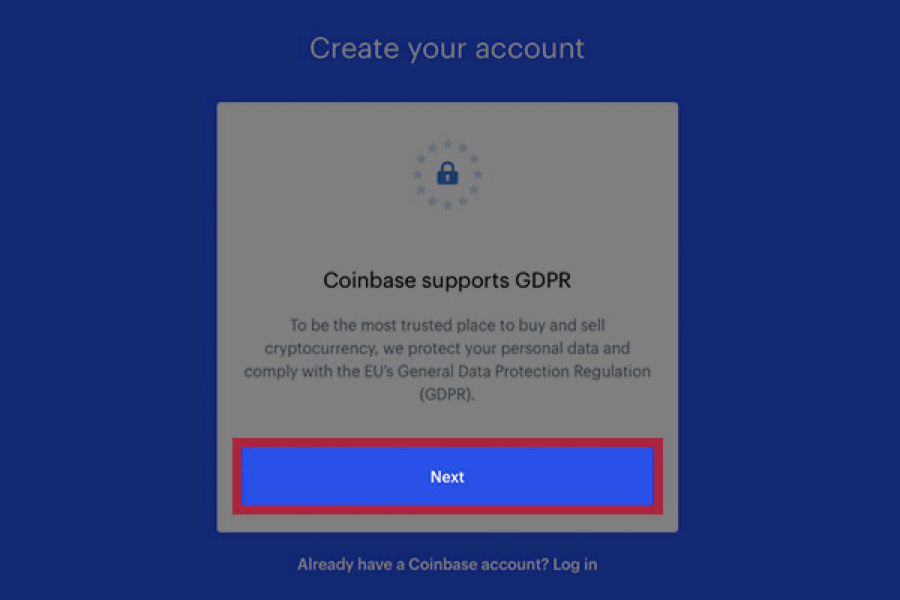

Step 3: Accept the GDPR

If you live in the European Union, you have to accept the GDPR basics. You can do it by clicking on the Next button, and after that, click on the button I acknowledge.

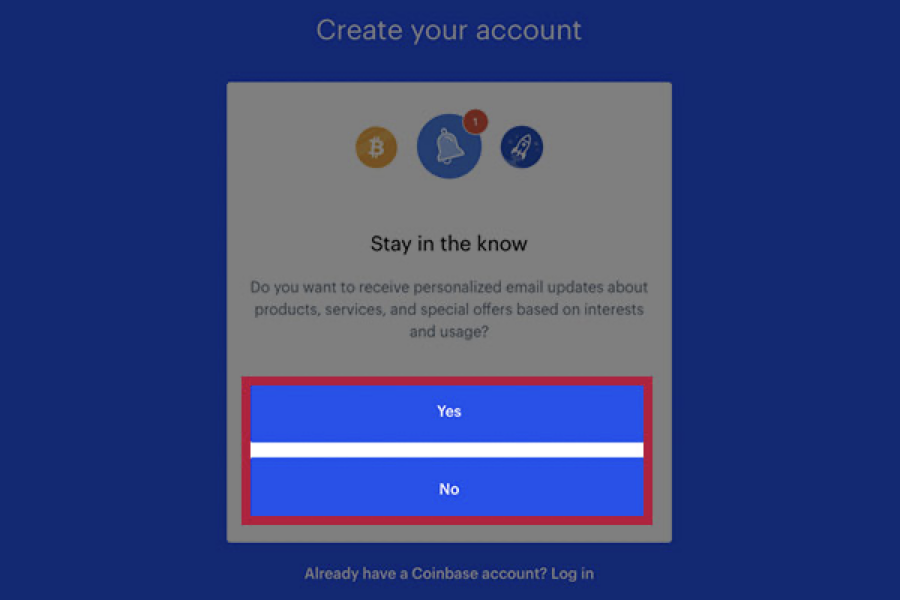

Step 4: Accept or reject the email updates

If you would like to receive personalized email updates about products, services, and special offers based on your account usage, click yes. Otherwise, click “no.”

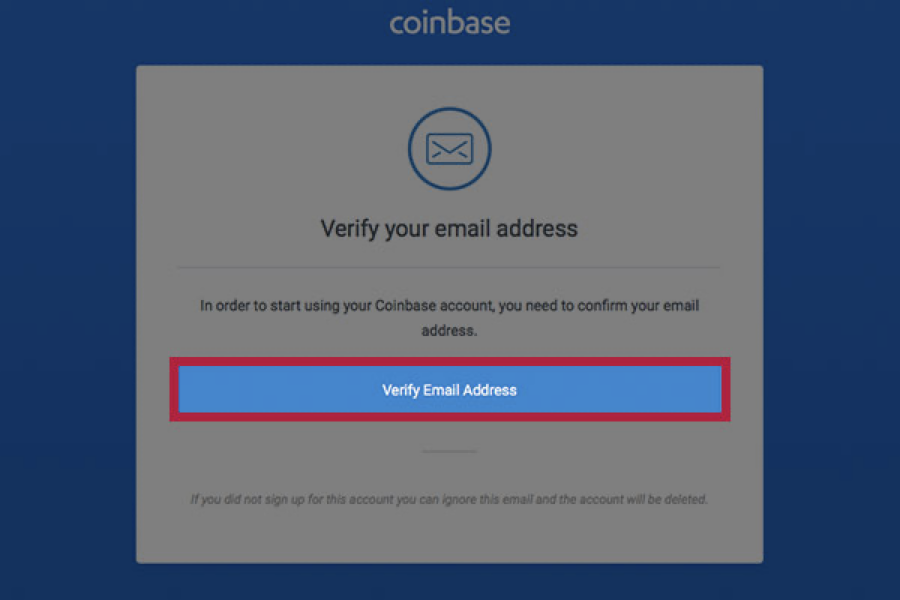

Step 5: Verify your email address

You must verify your email address after registering. Wait for Coinbase to send you an email with verification instructions, and then follow them. In most cases, you have to click the “Verify Email Address” button.

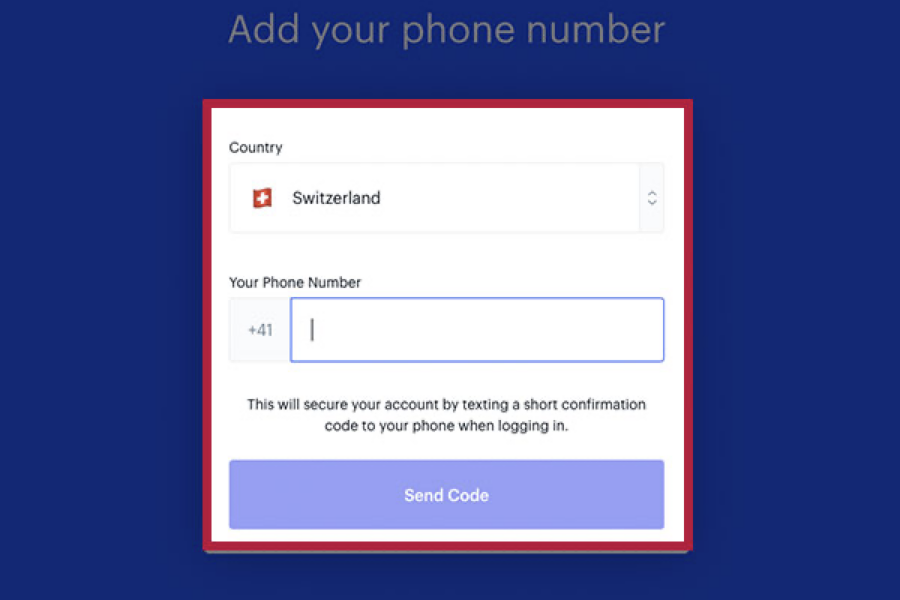

Step 6: You’ll be prompted to add a phone number

You need to select your country and enter your mobile number. Click “Send Code.” Verify it by entering the seven-digit code Coinbase texted to your phone number.

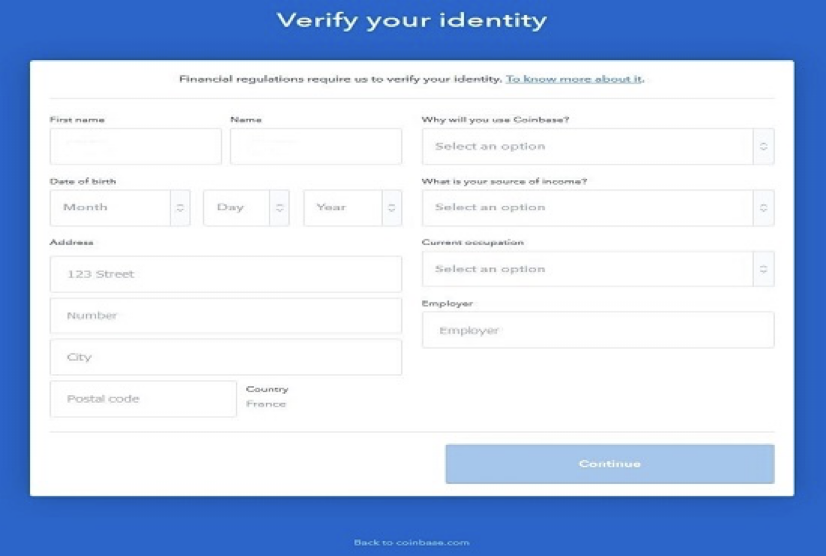

Step 7: Additional information about yourself

After phone verification, you must submit more personal information. You must enter your date of birth, address, and details about how you intend to use your Coinbase account. When you’ve completed all of the fields, click the “Proceed” button to begin the verification process.

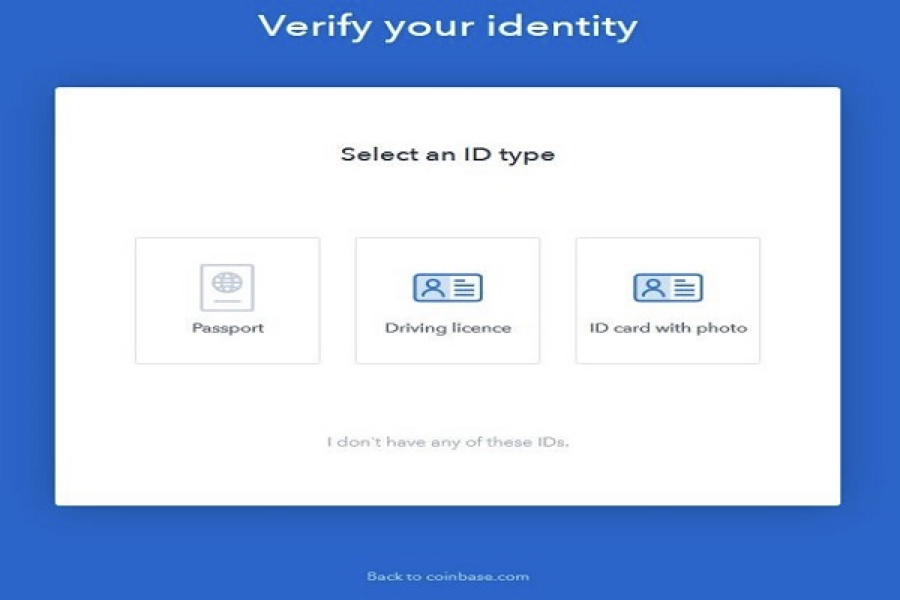

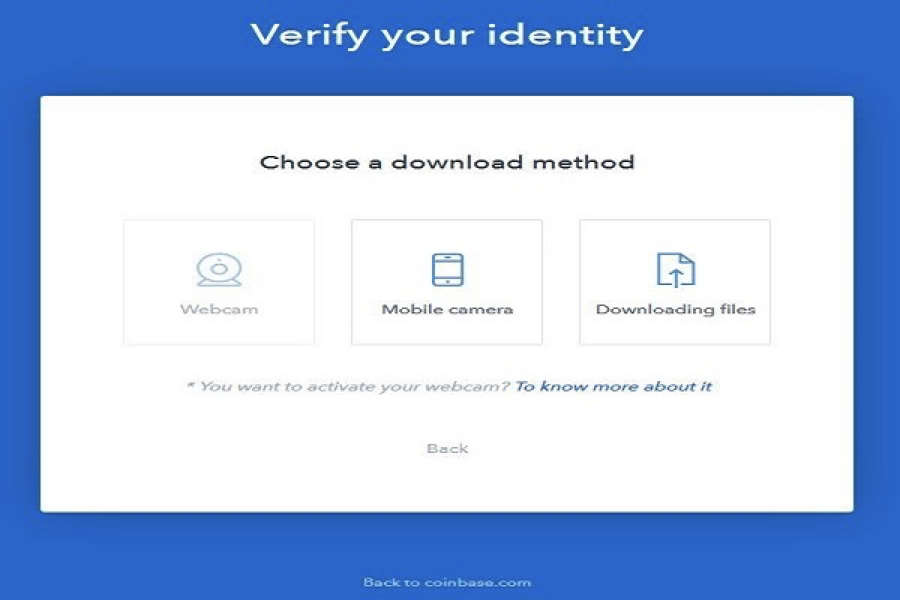

Step 8: Verify your identity

After that, you must authenticate your identity in order to gain access to all of Coinbase’s features. You can pass the verification by showing a photo of your ID or driver’s license.

Step 9: You have three options for sending this document: webcam, mobile camera, or file download (PDF preferred or quality photo).

Congratulations! Your account has been successfully created. Welcome to the world of cryptocurrencies!

How to deposit money in Coinbase?

Step to Deposit Money in Coinbase through Desktop:

- Log into your Coinbase account. Sign up for an account if you don’t already have one and give your credentials.

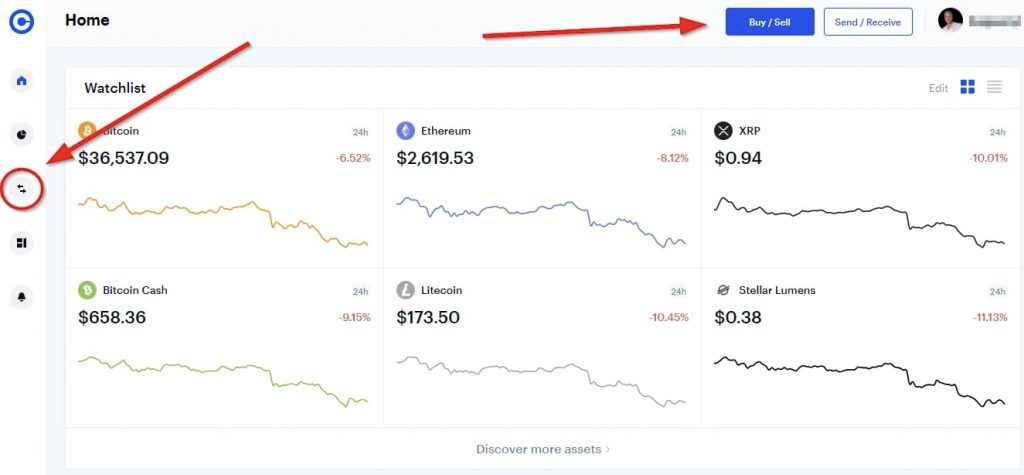

- On the top right menu, select “Buy/Sell.”

- Choose the cryptocurrency you wish to purchase.

- Add the card information from which you want to buy cryptocurrencies with cash.

- The crypto amount will show up in your wallet once the payment is completed.

How to withdraw money from Coinbase

Depending on whether you’re withdrawing money or crypto, the process may be slightly different. Let’s take a closer look at each step, and learn all you need to know about CoinBase, so you can earn all you want in cryptocurrencies:

Step 1: Convert your cryptocurrency to fiat currency.

This stage assumes you have some crypto funds but want to withdraw them in fiat currencies like USD, EUR, or GBP, among others.

To begin with, go to Coinbase.com and log in to your account. Then, as seen below, click the Trade button on the left navigation bar or the Buy/Sell button on the top right.

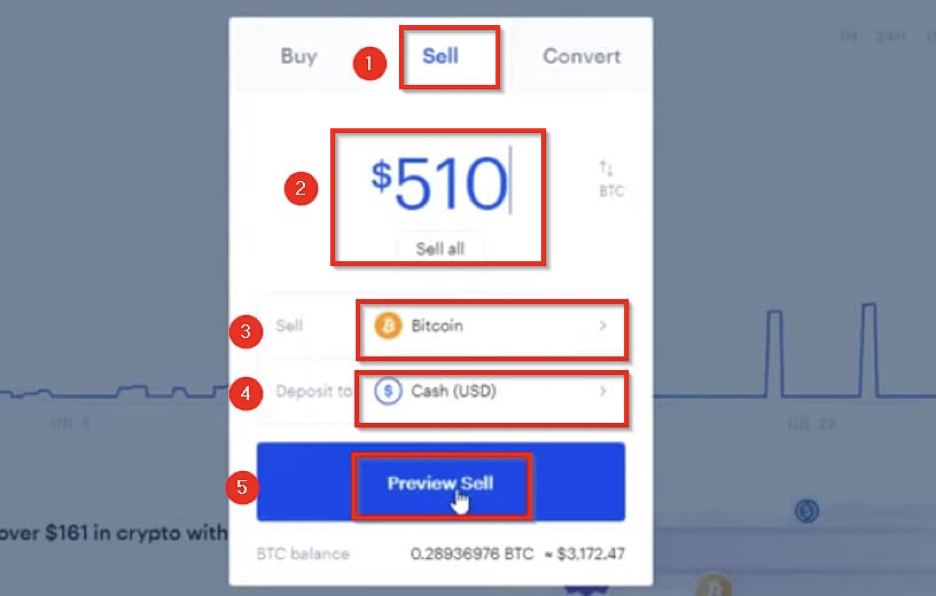

Coinbase will open a dialogue box where you can indicate the amount of cryptocurrency you want to trade for money. There are only five simple steps to follow.

To begin, go to the top of the page and click the “Sell” link, then enter the quantity of cryptocurrency you want to convert to fiat. Select the crypto asset whose balance you want to convert from the drop-down menu, then select the fiat money you want to withdraw in stage 4.

Finally, select “Preview Sell” to double-check your transactions’ information. The fees charged for the transaction, as well as the amount you will get in your fiat wallet, will be displayed in the confirmation box.

Step 2: Withdraw fiat currency balance.

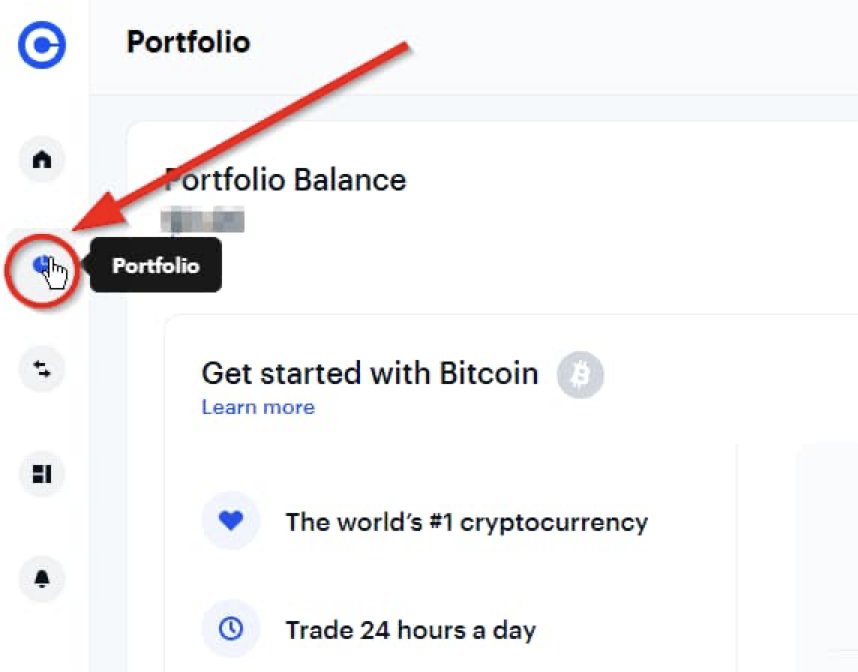

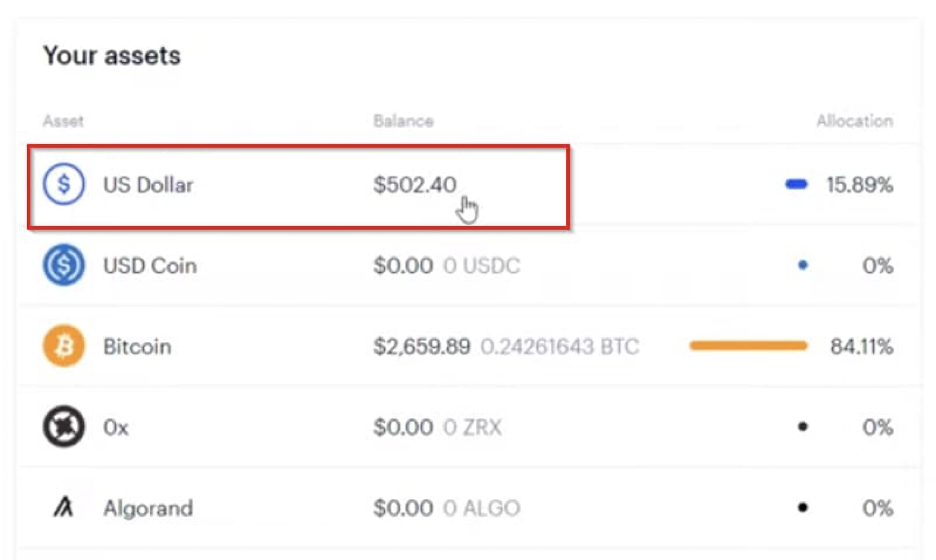

Navigate to your [Portfolio] page.

Scroll down to the “Your assets” area and click on the fiat balance you just converted from the previous section. We were converting USD in our case.

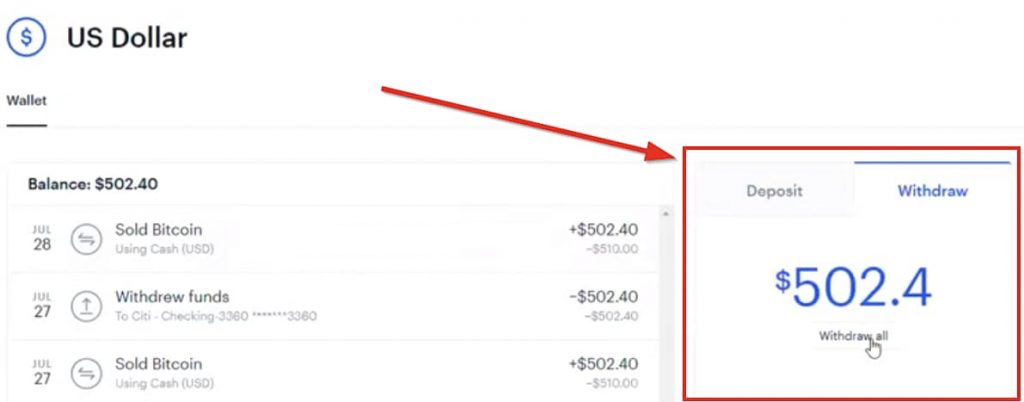

Select the ‘Withdraw’ tab on the right side box on the US Dollar asset page, then fill in the amount to withdraw, or click ‘Withdraw all’ to fill in the complete asset balance. To proceed, click the “withdraw” option.

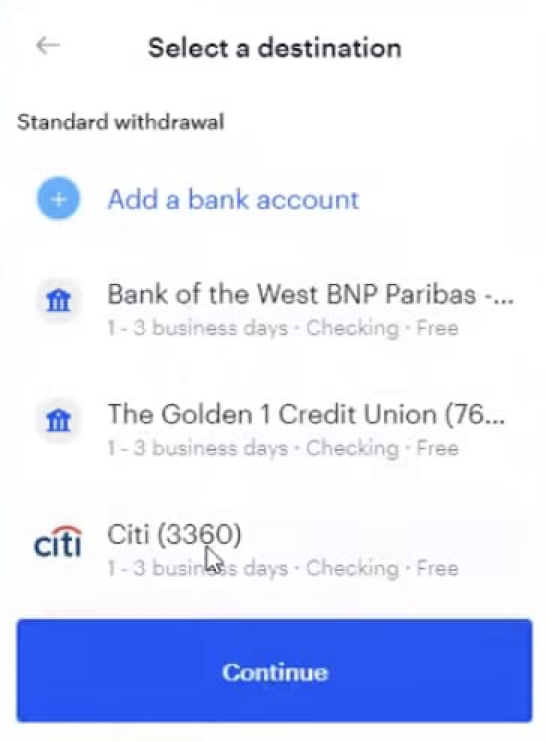

You can choose your payment method on the next screen, which includes bank transfers, PayPal, SEPA, credit/debit cards, and wire transfers. This screen’s selections are determined by the payment methods you’ve already linked to your Coinbase account.

To withdraw your funds, choose a payment option from your list and click the “Continue” button.

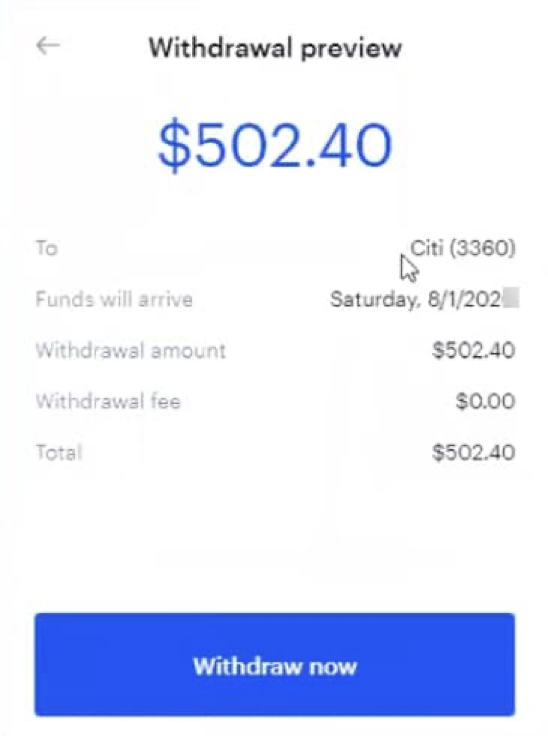

You will be given the transaction details to confirm on this screen. If you like, you may use the back arrow at the top left of the dialogue box to modify the payment method or the amount to withdraw.

If everything appears to be in order, click the “Withdraw now” option to complete the transaction. At this time, you’ll note that Coinbase does not charge any fees for fiat withdrawals. Instead, it charges a high fee during the conversion process.

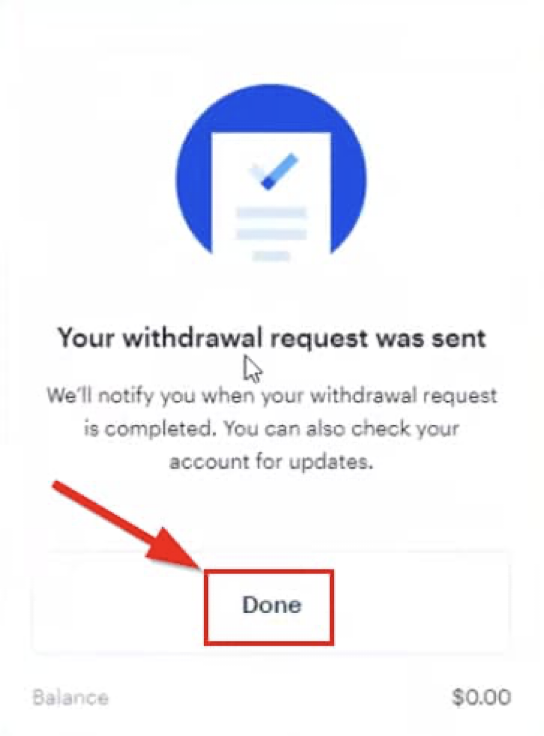

At this point, your transaction is complete, and Coinbase will execute it and send your funds to your payment method within the timeframe you specified. Select “Done” from the drop-down menu. This action will exit the dialogue box, and you can now browse to the history section of the particular asset’s page to view your transaction and other past transactions.

What cryptocurrency to trade on Coinbase?

- Bitcoin

- Ethereum

- Cardano

- Polkadot

- Solana

- Ripple

- Polygon

What stocks to trade on Coinbase?

- Cushman & Wakefield PLC (CWK)

- Allbirds Inc. (BIRD)

- Bath & Body Works Inc. (BBWI)

- Etsy Inc. (ETSY)

All reviews of the Coinbase platform

Coinbase is undoubtedly the most well-known cryptocurrency exchange. Bitcoin early adopters have been buying and trading coins on Coinbase since 2012, but the platform gained mainstream attention in 2021 when it became the first crypto exchange to go public on the Nasdaq.

Coinbase now has over 56 million users who trade over $300 billion in cryptocurrencies each quarter. According to crypto research firm CoinMarketCap, it has the third-highest trade volume of all exchanges.

Here’s everything you need to know about using Coinbase to purchase, sell, and hold cryptocurrency:

How does Coinbase work?

Learn all you need to know to start earning with CoinBase: Users can use Coinbase to buy, sell, and spend cryptocurrency. It also provides services for businesses, such as enabling them to accept bitcoin payments, as well as cryptocurrency wallets for storing cryptocurrencies in a secure location (more on that later).

Coinbase is strictly a currency exchange and custodian, unlike some of the other places where you can acquire cryptocurrencies. Stocks, options, and other sorts of investments are not available. Coinbase, on the other hand, is the largest cryptocurrency exchange in the United States, with a large range of useful instructional tools for cryptocurrency investors and traders of all levels.

Security of the platform

If you want to earn crypto, you need to learn about the security of the CoinBase cryptocurrency exchange. Cryptocurrency, unlike cash in the bank, is not covered by any federal restrictions.

Coinbase claims to keep 98 percent of its customers’ bitcoin in cold storage (the remaining 2 percent is used to facilitate trading volume). The exchange also has a policy that protects cryptocurrency assets. According to experts, rigorous procedures like this are why a mainstream exchange like Coinbase may be worth the extra fees.

Even if your crypto is taken in a big security breach, there’s no guarantee that your money will be returned to your wallet. In those circumstances, “We shall attempt to make you whole,” Coinbase writes on its website. However, total losses may exceed insurance reimbursements, resulting in the loss of your funds.

Losses resulting from unauthorized access to your personal account are also not covered by the insurance policy. To put it another way, if your identity is stolen or someone discovers your Coinbase account password and steals your wallet, you may not be able to restore it.

Most customers don’t need to store cash on Coinbase (just as they wouldn’t retain uninvested cash in a traditional investment account), though it can be useful for speedier trades. However, any cash you maintain on the exchange is pooled with other users in one of three ways: stored in US bank accounts, invested in US treasuries or money market funds, or held in US bank accounts. You don’t get to choose how your money is stored. However, Coinbase claims that money kept in bank accounts as cash is FDIC-insured up to a current limit of $250,000.

Two-factor authentication, biometric logins (such as fingerprints and Face ID), and data encryption are among the other security features. Use strong passwords; don’t reuse passwords across accounts; enable 2-factor authentication; and keep an eye on your accounts for any unwanted activity.

Exchange fees

CoinBase learn and earn need to include all the fees you should know about. When compared to other exchanges, one of Coinbase’s main flaws is its exorbitant charge structure.

You’ll be charged a spread and a Coinbase fee when you perform a cryptocurrency transaction on Coinbase, such as buying Bitcoin or exchanging Ethereum back into US dollars.

The spread is the difference (or margin) between the market price and the actual price you pay or get for a buy or sale. It’s comparable to what you’d pay as a commission or trading cost if you invested through a brokerage account.

Coinbase’s spread is roughly 0.50 percent of your bitcoin sales and purchases, though it varies depending on market conditions. For cryptocurrency conversions, such as trading Bitcoin for Ethereum, you may be charged a spread of up to 2.00 percent based on market movements.Converting your crypto coins to other cryptocurrencies, on the other hand, does not incur a Coinbase fee.

The Coinbase fee varies depending on the payment type you use, your region, and other factors. It could be a flat cost or a percentage of your transaction, but the latter will always be higher.

So, if you buy $50 worth of Bitcoin on Coinbase with a bank transfer, you’ll pay a $0.25 spread plus the $1.99 flat fee (which is higher than the 1.49 percent alternative fee). That implies you’ll end up with approximately $47.76 in Bitcoin. That may not seem like much, but the more you buy, the more it adds up.

Other Fees

You can also deposit money into your Coinbase USD wallet and then buy cryptocurrency from it later (for the 1.49 percent fee described above).Because crypto values fluctuate so rapidly, holding USD in your Coinbase wallet might save you time and money if you need to react quickly to a price reduction.

Coinbase earn

Investing in cryptocurrency requires a lot of education, especially for novices. Coinbase has a Coinbase Learn hub featuring beginner’s guides to various coins and uses of bitcoin, as well as regular market updates and recommendations for more resources.

Through Coinbase Earn, it also encourages users to actively learn. You may learn about certain altcoins by watching short films and taking quizzes, and Coinbase will deposit a tiny amount of that cryptocurrency into your wallet as a reward.

Build-In wallet

When it comes to crypto storage, Coinbase has a variety of solutions.

To begin with, you can store your cryptocurrency on Coinbase. This is the most straightforward option: simply log into your account, purchase your cryptocurrency, and keep it in your account. You won’t have access to your private keys if you do this; instead, Coinbase’s security procedures will protect your funds (and your own account protection).

You can also migrate your funds to Coinbase Wallet, the company’s standalone hot wallet program. This is a different program that you would download, and it does offer you control over your private keys, unlike storing your funds on Coinbase. Because you have more control over your cryptocurrency, you can do things like transfer coins between wallets and participate in other decentralized finance activities that require crypto transfers and payments outside of the exchange. It’s not necessary, however, if you’re only looking to buy and hold Bitcoin or another cryptocurrency for its asset value.

Mobile app

Coinbase is a highly functioning website and has a user-friendly mobile app that allows users to purchase, sell, and manage their bitcoins from anywhere. It has a 4.7-star rating in the Apple App Store and a 4.4-star rating in the Google Play Store.

Pros and cons

Pros

- Cryptocurrency selection

- Minimums are low.

- App with the highest user rating

- Platform for advanced trading.

- Provides free cryptocurrency to those interested in learning about new digital tokens.

- It provides a Coinbase debit card that may be used to spend cryptocurrencies wherever Visa is accepted.

Cons

- The fee structure is tough to understand.

- Fees for lower purchases are too costly.

Coinbase Support

Customer support for Coinbase is provided via email. Aside from that, it has a large and diverse knowledge base that it makes available through its learn and earn program and thorough FAQ.

You may also utilize the FAQs column to find answers to most of your questions. Coinbase provides 24/7 email assistance. By clicking the “Contact Us” button, you can reach out to the support team.

What’s Unique About Coinbase’s IPO?

The Coinbase tale has a few odd components, starting with the fact that it is the first firm of its sort to go public.

Other companies offer comparable services, but Coinbase stands out as the gateway to cryptocurrency for individuals all across the world. As a result, it is well positioned to thrive as a publicly traded firm.

Furthermore, the Coinbase IPO is not a true initial public offering because it is listed directly on the Nasdaq, which is a less traditional way of doing it. It avoids the costly partnership with investment banks that helps sell shares of a new stock during an IPO by doing so. Coinbase also maintains loyalty to its decentralization identity by using its popularity (and financial records) as a selling point.

Conclusion on Coinbase, and if you can learn and earn easy

Coinbase is a safe and simple marketplace for purchasing and selling digital assets. Coinbase, on the other hand, has a significant disadvantage in the form of exorbitant fees. Aside from that, the exchange remains unrivaled in terms of features.

Beginners and advanced traders both benefit from Coinbase’s broad exposure to the financial world. Coinbase is a great place to start trading because of its vast choice of crypto assets and tools like Coinbase Earn and USDC Stablecoin.