What’s worse? A deep recession or a fall in consumer prices? And the fall of oil prices as well? The answer is simple – a deep recession accompanied by a fall in consumer prices. Consequently, markets are afraid of far more than the headlines in the media might seem. If the spread of coronavirus only threatened the economy, one could wave it. But there are more factors to suggest that prospects are not pink. Besides the coronavirus infection, it is also a consequence of the closure of several operations around the world. Similarly, the restrictions on the free movement of persons and the “perfectly timed” oil war between Saudi Arabia and Russia. The effect of this situation is linked to oil prices.

The situation about coronavirus infection

Scott Grannis is a former chief economist at Western Asset Management. He says that it is hard to imagine how the situation could be worse. “Coronavirus infection is reminiscent of an avalanche, and international transport is collapsing. Businesses are drastically reducing production. Also, restaurant or hotel owners are considering whether to reopen at all. Therefore, miss the predictions of a skyrocketing unemployment rate with tens of percent of GDP projections in some countries.”

Losses on the financial markets are astronomical. Most stocks indices dropped by 30-40% in the last month, up to $30 trillion “disappeared” from world exchanges.

Oil now compared to 2008

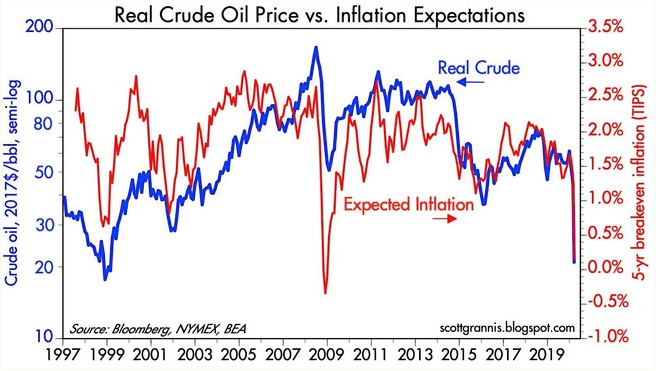

The following chart also indicates the fact that the world is in trouble. It compares the evolution of oil prices, the decline of which is the result of the price war between Saudi Arabia and Russia, and the expected development of consumer prices.

Assuming that the chart is not wrong, we are in a very similar situation as in 2008. If the world does not want to experience a lost decade, Saudi Arabia and Russia need to make a ceasefire, and governments around the world will relax the restrictive measures due to the spread of coronavirus infection.

“If business downturns take longer, we will eventually find that the damage done by these measures is far greater than the losses that coronavirus itself is threatening,” warns Grannis, recommending that people and politicians side-by-side victim statistics coronavirus and common seasonal influenza. “I do not want to say that coronavirus is not dangerous, but I ask whether it is not possible to choose another way of fighting it, perhaps following the example of South Korea,” he adds.

If you wish to follow the oil prices, keep an eye on this chart.